Rated “Excellent” On Google Reviews

Goods In Transit &/or

Public & Employers’ Liability

Insurance

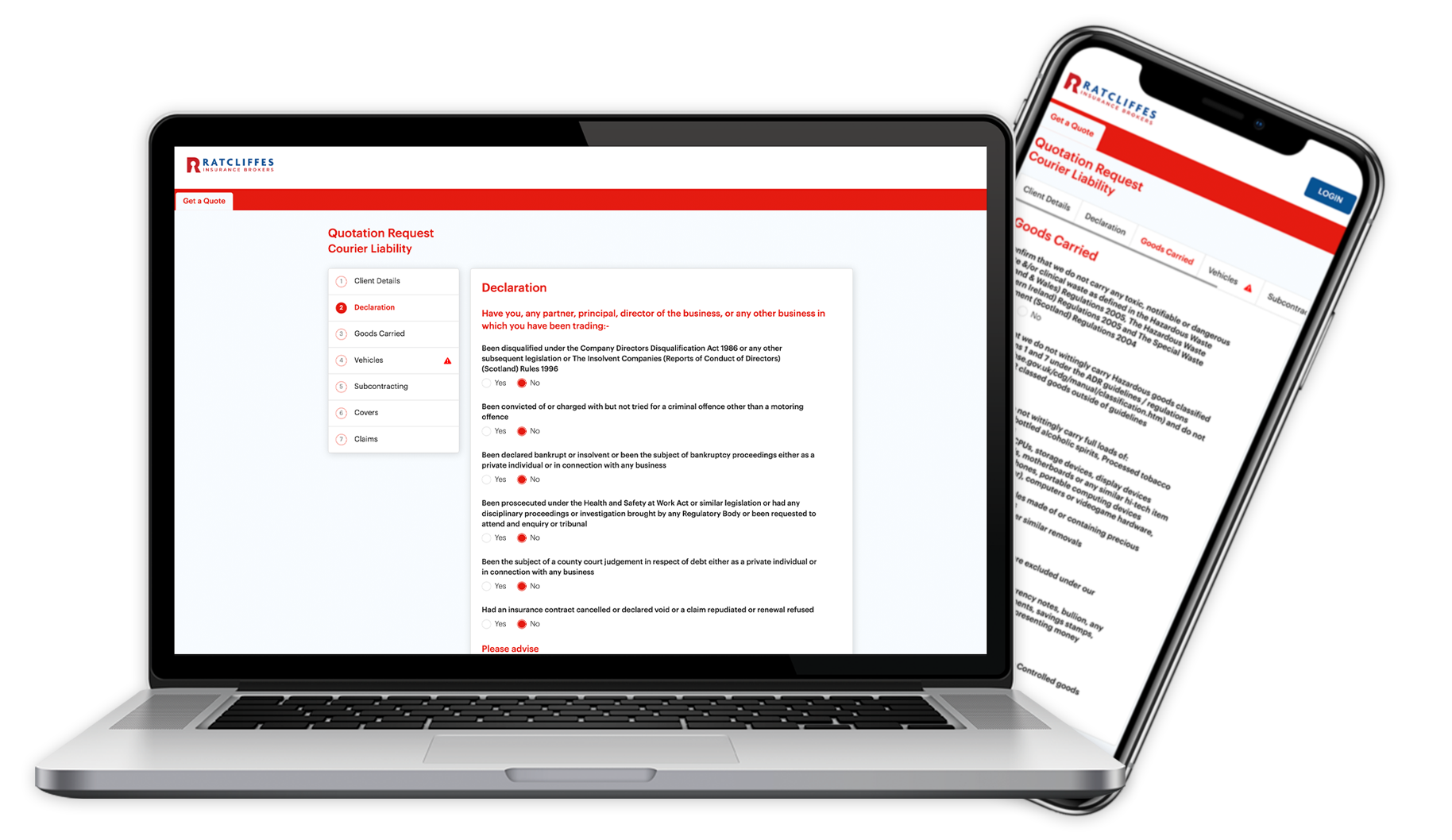

From quote to purchase, all the way to managing your policy. At Ratcliffes, you can do it all with a few touches.

- Buy Direct - Pay Less

- £100k Limit For Courier Networks

- 24/7 Easy Policy Changes

- A-Rated UK Insurers

Options For Couriers & Any Light Haulage

Below is a sample of our network options

- Backed By A-Rated Insurers

- All Your Haulage & Delivery Needs

- Instant Online Prices

HOW IT WORKS?

Quote, Compare & Buy Goods In Transit &/or Public & Employers’ Liability Insurance

You can compare prices, make a purchase, and manage everything online in just minutes. Simply enter your details, find a price that fits your needs, and complete your purchase effortlessly.

Enter Your Details

Simply enter your details into our online quote comparison system and discover multiple deals in a matter on minutes.

Compare Multiple Deals

Review our list of trusted insurance providers and find the right solution that fits your needs.

Online Purchase

That's right you can Quote and buy your Goods In Transit insurance online via us today, feel free to reach out to our team if you're unsure or need more information.

Why Choose Our Goods In Transit, Public & Employers’ Liability Insurance?

For couriers and light haulage drivers, the safe delivery of goods is the backbone of your business. Goods in Transit insurance protects the items you’re responsible for while they’re being transported from one location to another. It covers loss, theft, or damage to goods, ensuring your operations aren’t disrupted by unforeseen incidents.

- Limit of £100k for courier networks such as Amazon and Evri

- Goods In Transit policies from £82.20 inc

- Public Liability policies from £65.40 inc

- Public & Employers’ Liability policies from £76.60 inc

- Public Liability limits up to £10 million

Whats covered?

Your Goods*

- Theft of goods during transportation

- Damage to goods caused by accidents or other unforeseen events

- Loss of goods in transit

- Protection for valuable or high-risk items (e.g., electronics, machinery)

- UK and EU coverage for goods while on the move

Your Business*

- Cover for subcontractors handling goods on your behalf

- Financial protection for delayed or lost deliveries

- Insurance for legal liability if goods are damaged or lost

- Compensation for business losses due to undelivered goods

- Protection against claims for damaged goods from customers or third parties

Your Security*

- Flexible policy options to increase cover as your business grows

- Exclusively A-rated insurance companies, ensuring top-tier protection and reliability for your business.

- EU-wide cover for cross-border deliveries

- Coverage options for multiple vehicles or large fleets

- Guaranteed cover limits to match your contractual obligations

*Always subject to the terms, conditions and limits of your policy and plan. Some benefits are not available on all options, speak to our team to discuss your options today.

Get started today and get an instant price

To get started, simply request a quote and fill out our short quote form, or give us a call directly.

4.5/5 Rated As “Excellent”

Rated 'Excellent'

Easy to use Quote & Buy System for Goods In Transit, Public & Employers’s Liability Insurance.

Policy changes made at the tip of your fingers.

Paul Gooch

I’ve used M R Ratcliffe Consultants for over 20 years. Always given the best quotes available. Always ready at the end of the phone if you have a question. If a vehicle change is ever needed it’s just matter of a phone call and it’s done. I would recommend Ratcliffe’s every time.

Nina Hatcher

I have renewed commercial policies with them now every year since 2017.

Fantastic company to deal with, with great customer service too.

Helen Wolfe

We have been with Ratcliffes for over 20 years. We obviously get quotes every year, and some are a little cheaper ,but they have never failed to give us excellent service, often at very short notice. They know their trade well and thats what we need to be able to get on with ours.

Ged Welsh

Very approachable and helpful hence why I have been a customer for many years

Paul Knowles

Yet again one of “The” best companies to deal with. Professional, Knowledgeable, Communicative, Efficient and competitively priced. Excellent all round.

Paul Drake

Brilliant service, easy to get hold of the correct person and every body you speak to is very pleasant and helpful. Very competitive prices, best about.

Alan Curtis

Absolutely brilliant company, Karl managed to save me more than a few quid on my truck insurance compared to other companies and an absolute pleasure to deal with too

Jeffrey Ellis

Always a pleasure dealing with you!!

Ask Our Experts

Goods in Transit insurance covers your items while they are being transported. It ensures that you are protected against loss, damage, or theft during transit, providing peace of mind and financial security.

This insurance is ideal for couriers, light haulage drivers, and businesses that regularly transport goods, whether domestically or over seas. It ensures protection for valuable items while on the move.

Most types of goods can be covered, including personal items, business goods, and equipment. Some high-risk items, such as fragile or high-value goods, may require special conditions or coverage.

In case of loss, damage, or theft, you’ll need to report the incident to your insurer or via the online admin portal as soon as possible, provide details of the event, and supply any supporting documentation like invoices, proof of value, and photographs of the damage.